APEX LANDMARK – ASSET MANAGEMENT DIVISION

Apex Landmark Asset Management division is aimed to manage capital from different groups of domestic and international investors. Our core investment areas include private equity, mergers & acquisitions and global innovation ecosystem. We make use of the combination of the best expertise and knowledge of the international and domestic investment markets so as to enable us create an outstanding long-term value for our investor partners. Every of our Apex Landmark Capital team of professionals have extensive experience in U.S and international investments and asset management. At Apex Landmark we work by the application of a deep knowledge of business and financial markets with world-class investment expertise to create an enabling environment where values are maximized for our investors.

Industry Sectors:

- Life Sciences and Healthcare

- Energy Resources: Oil & Gass and Offshore

- Technology

- Real Estate

- Consumer and Industrial Products: Wholesale & Distribution

ASSET MANAGEMENT CATEGORIES:

|

Analyzing the operations and financial performance of prospective merger and acquisition candidates, and where appropriate, preparing the target companies’ existing strategy and operations for the changes anticipated by the merger or acquisition. For instance, there may need to be changes in board composition, strategic direction, management personnel and/or procedures, technology or manufacturing processes, or company identity. These issues must be addressed in advance of the acquisition and, better yet, be contemplated in the acquisition negotiations and planning, before closing.

Overseeing the merged or acquired businesses on an on-going basis and our clients will have little or no familiarity with business practices in the United States and will require our assistance to guide the merger implementation process and oversee operations on its behalf. In addition, as the acquired businesses mature, whether the investment is either strategic or portfolio, it will require continual oversight and possible changes in operations and capitalization. Given the dynamic nature of economic conditions everywhere, every company will require changes in technology, marketing and market positioning, senior management and other organizational considerations, and of course, from time to time, changes in capitalization, including eventual sale of the investors’ original acquisition interest. |

|

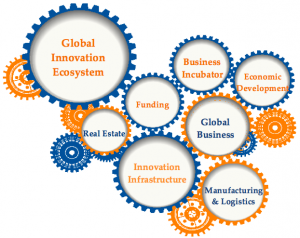

Through creations of our dedicated venture capital investment vehicles, Apex Landmark seeks to commercialize technologies of domestic and international universities and research institutions. We seek to distribute final commercialized technology products into domestic U.S. market and large Chinese market to maximize success rate of each investment. Our strategic institutional investors will also serve as distributors and consumers of commercialized technology products. It will also attract both domestic and international corporations to be engaged in building strong university/research institution and Industrial partnerships. |

|

|

Research & Innovation

• Technology commercialization through universities and research institutions intellectual property portfolio.

Funding

• Provide seed capital as well as subsequent series A & B funding and Series C exit strategy.

• Additional resource support including office space, mentorship and resources.

Manufacturing & Logistics

• Provide in-depth product development support.

• Available domestic and international logistics full service support to better serve market demands.

Marketing & Sales

• Provide access to some of China’s largest energy and healthcare companies and its distribution network and channels.

• Secure product placements with strategic investor partners to expand market.

|

IoT and Cloud ComputingSmart Home & Building

Energy, Healthcare & Environment Industries

|